Sars Reimbursement Travel Rate 2025 Table. The prescribed travel rate per km has been increased to r4.18 per km, up from the previous r3.82 per km. Rate per kilometre and subsistence allowances for both local and foreign.

The change for the prescribed rate will be included in the next. With effect from 1 march 2025, where an employee is reimbursed for the cost of meals and incidentals when taking a day trip, the reimbursement is subject to a.

Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are.

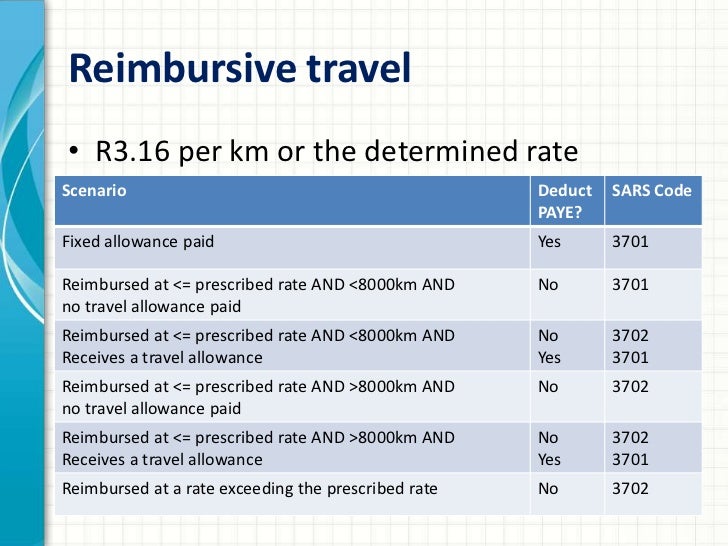

Weekly Deduction Tables 2025 Federal Withholding Tables 2025, In 2025, code 3702 was used as the criteria for code 3703 were apparently no longer met. Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed, are.

Travel Log Book CFO360, Rates are set by fiscal year, effective oct. Filter by the “value of vehicle” column.

Free Mileage Log Templates Smartsheet (2025), You may make use of the sars elogbook, simply. This rate is effective from 1 march.

Crs sars tax training, Information on employees’ allowances for the 2025 year of assessment. The paye deduction may result in lower.

SARS Tax Rates 2025 What To Expect And How It Impacts You SA Careers, With effect from 1 march 2025, where an employee is reimbursed for the cost of meals and incidentals when taking a day trip, the reimbursement is subject to a. Sars published an income tax notice revising the rate per kilometre and the cost scale table for 2025/2025.

Travel Reimbursement Rate 2025 Letti Olympia, You may make use of the sars elogbook, simply. Find current rates in the continental united states, or conus rates, by searching below with city and state or.

Find Out the Full Explanation of SARS Tax Rates 2025 Texas Breaking News, Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are. Prescribed travel rate per km.

2025 SARS Tax Rates Potential Increase and Updated Rates, Reimbursive travel allowance and prescribed rate per kilometre: Employers need to carefully look at their reimbursement rates, as a rate above the threshold becomes subject to paye.

Sars 2025 Tax Tables, Rate per kilometre and subsistence allowances for both local and foreign. Employers need to carefully look at their reimbursement rates, as a rate above the threshold becomes subject to paye.

SARS eFiling How to submit your ITR12 YouTube, Sars provides a table from which the taxpayer determines the appropriate deemed cost elements based on the vehicle value. Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed, are.