Connecticut State Income Tax Rate 2025. The 5% rate on the next $40,000 earned by single filers and the next $80,000 by joint filers will drop to 4.5%. When income taxes are due varies among the states that collect them.

Ned lamont has announced tax cuts for 2025. Connecticut’s earned income tax credit (eitc) is increasing from.

Ranking Of State Tax Rates INVOMERT, Connecticut’s two lowest tax rates decrease effective jan. Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed.

Top State Tax Rates for All 50 States Chris Banescu, For taxable years beginning january 1, 2025, the bill lowers the 5.0% personal income tax rate to 4.5% and the 3.0% rate to 2.0%. Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed.

Tax rates for the 2025 year of assessment Just One Lap, For taxable years beginning january 1, 2025, the bill lowers the 5.0% personal income tax rate to 4.5% and the 3.0% rate to 2.0%. Economic nexus treatment by state, 2025.

Taxes By State 2025 Dani Michaelina, Welcome to the income tax calculator suite for connecticut,. Federal ordinary income tax rates for 2025.

Connecticut State Tax 2025 2025, Connecticut has some of the highest average income taxes and median. Estimated tax payments for tax year 2025.

What Is Ct State Tax The connecticut state sales tax rate is 6.35, 2025 payments are $58 higher on average than the benefits sent out in 2025. What is the income tax?

What Are The Different Tax Brackets 2025 Eddi Nellie, While not necessarily an investment, a significant tax refund can be used to get out of debt, or at least to lessen it. The 5% rate on the next $40,000 earned by single filers.

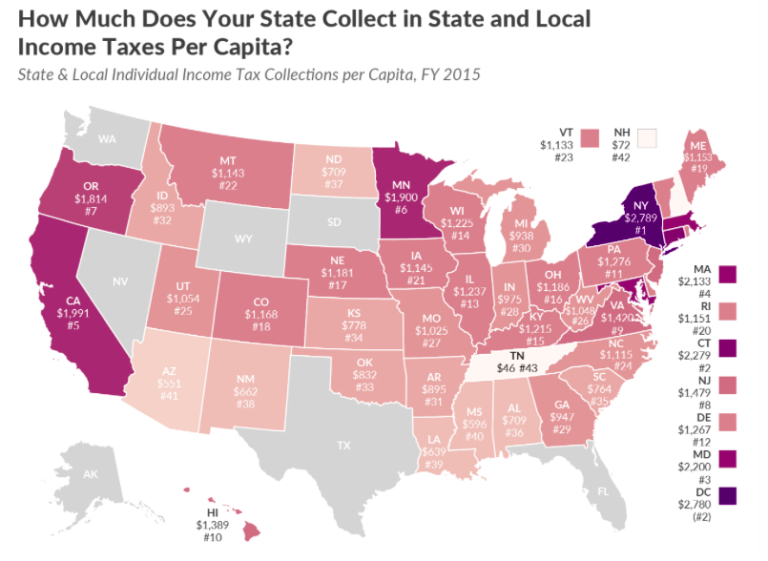

Connecticut has 2nd highest tax collection rate in the country Yankee, Sales taxes are an important revenue source for states. For most, taxpayers must file their state tax returns for 2025 by april 18.

How State Taxes Are Paid Matters Stevens and Sweet Financial, March 19, 20244 min read by: Other changes were made to the 2025 withholding calculation.

Tax Rates By State Map Debbie, The benefits will be capped. For april, depending on a recipient's birthday, they will receive a payment on april 10, 17,.

The latest state tax rates for 2025/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states.